New Public Charge Rule for U.S Visa Applicants

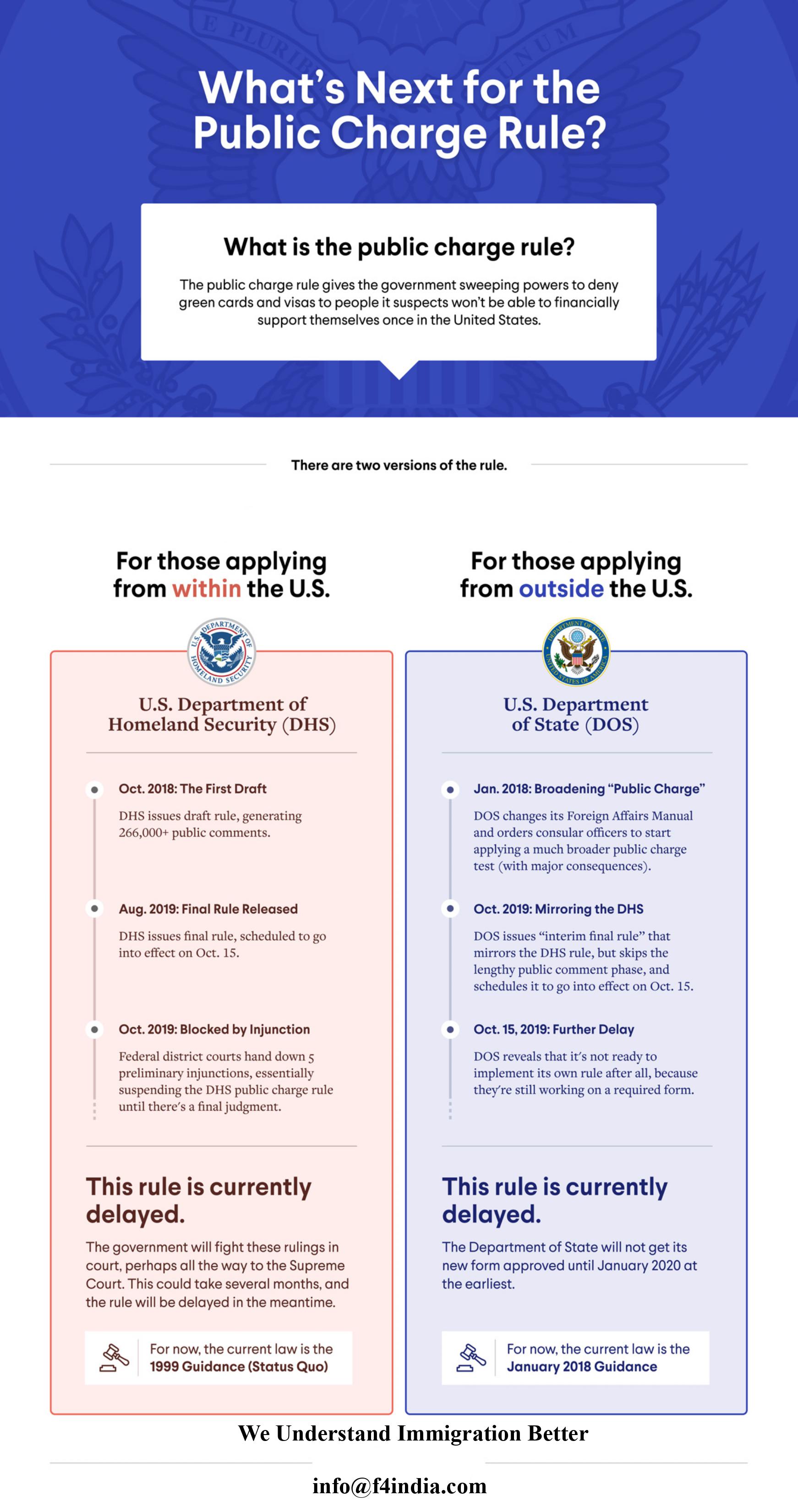

Public Charge Effective Date :

The Public Charge Final Rule became effective on 24, February 2020 and it affects all Adjustment of Status and non-immigrant visa filings here in the U.S, postmarked on or after 24, February 2020, as well as all pending and future filings abroad.

Who is Subject to the Public Charge Final Rule :

Intending immigrants who are filing for a visa abroad or for Adjustment of Status in the United States are subject to the rule, as well as non-immigrant visa applicants overseas and non-immigrants seeking an extension of stay or a change of status.

Who are Exempted From the Public Charge Final Rule:

What about Benefits Received Before February 24, 2020 (the Effective Date):

Benefits which are subject to the Public Charge Final Rule but were NOT considered public charge evidence before will not be a negative factor for determining public charge but those which WERE subject to exclusion under the prior guidance and were received within the thirty-six months prior to the 24, Feb 2020 Effective Date will be negative factors in Public Charge Final Rule analyses.

Receipt of these benefits after 23, Feb 2017 will likely be used as an adverse factor in determining public charge because they are listed in the 1999 field guidance:

Receipt of these benefits before February 24, 2020 will likely NOT be an adverse factor in determining public charge because they are NOT listed in the 1999 field guidance:

What kind of Benefits Can Trigger Public Charge Exclusion or Removal ?

The Department of Homeland Security (DHS) will only look at benefits received directly by the applicant for their own benefit or for which the applicant is listed as a beneficiary of public benefits. This includes:

What Amount or Duration of Benefits is Likely to Trigger a Public Charge Exclusion or Removal?

MEDICAID: DHS will NOT consider:

GUARDIANSHIP: DHS will NOT consider public benefits received on behalf of someone for whom they have guardianship or power of attorney.

HOUSEHOLDS: DHS will NOT “attribute receipt of a public benefit” by household members to the applicant unless the applicant is also a beneficiary.

CHILDREN: Benefits for children, natural or adopted, of an applicant who become U.S. citizens or enter the U.S. to attend a citizenship interview will not be counted under the Public Charge Final Rule

U.S. MILITARY: If the foreign national was enlisted in the U.S. armed forces or serving in active duty while a reservist, when the benefits were received by them or their family members, those benefits will not count against the service member under the Public Charge Final Rule.

ADOPTIONS: Benefits paid to children born to or adopted by United States Citizens living in abroad will not affected under the Public Charge Final Rule.

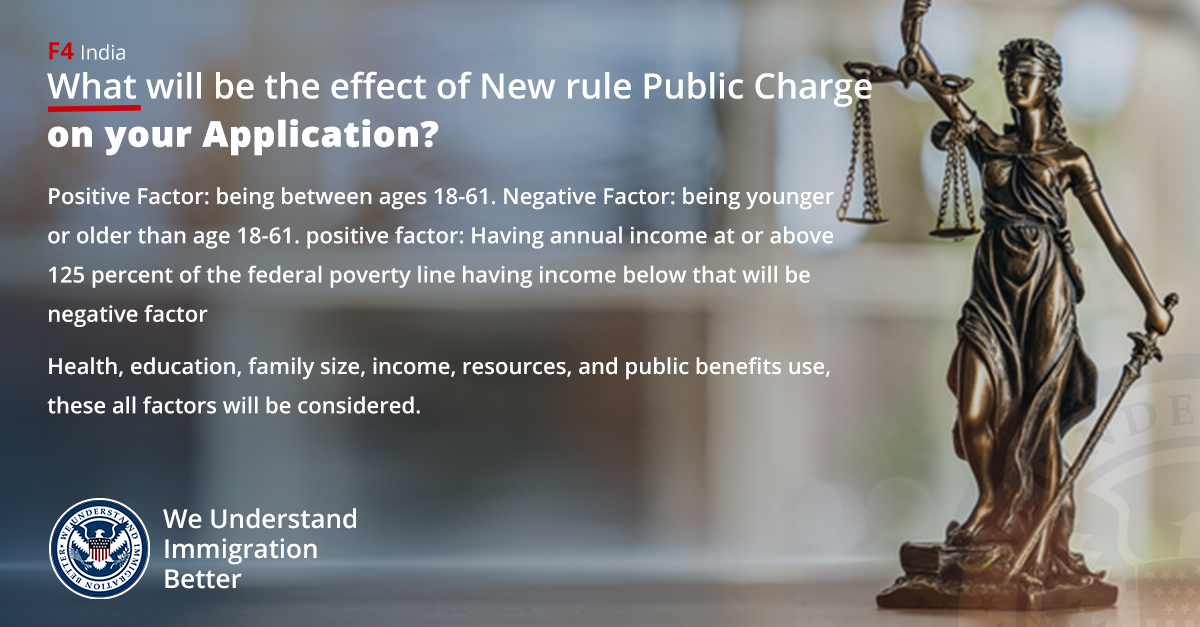

What kind of Factors can Likely Trigger an Inquiry into Public Charge Exclusion or Removal:

What Factors will DHS Treat Favourably in Determining Whether a Public Charge Exclusion or Removal is Appropriate?

What about DOS? Are there particular factors which will weigh for or against an applicant in determining public charge: One of the ways that the U.S. Department of State’s public charge approach overseas is different from the U.S. Department of Homeland Security’s approach stateside is that the DOS Foreign Affairs Manual does not contain positive and negative factors the way that DHS’ regulations do. While DOS and DHS apply a “totality” test which weighs positive and negative factors, DOS doesn’t have a specific list of factors and how they fit into the analysis.

It may be that the DS-5540, Public Charge Questionnaire itself provides the best indication of what factors are weighed in DOS’ analysis. The form focuses on:

Additionally, DOS Seems to be Also Looking at:

Conclusion: The “Totality of the Circumstances” test applied by the U.S. Department of Homeland Security in the U.S. and by the U.S. Department of State abroad gives federal officers wide latitude in determining the public charge. Whether a particular factor will weigh more or less heavily in the analysis will become more evident the farther from the February 24, 2020 implementation but experienced immigration attorneys are in a particularly good place to make educated guesses at how individual circumstances will affect public charge determination.

Because each case has to be analysed on its own merits, this piece should not be treated as legal advice. Proper analysis requires careful consideration of individual factors and those who may be subject to a public charge finding should seek the advice of competent counsel.

F4 INDIA is a full-service immigration law firm with the resources and expertise to help clients with complex matters like this. Please contact us at info@f4india.com.